Get latest company news company results company interviews company financials company analysis company disclosure corporate news company announcements at Business Standard. 162016 on 26 th December 2016 the process of striking off the name of the Company from the Register of Companies through the Fast Track Exit often called FTE stands revisedThe Fast Track Exit mode and.

In most companies the company directors must hold a board meeting to officially declare interim dividends.

. Dividend As per Section 235 of Companies Act 2013 defines the term as including any interim dividend. DECLARATION AND PAYMENT OF DIVIDEND. Section 129 of The Companies Act 2013 Financial Results.

However dividend income over and above 1000000 attracts 10 percent dividend tax in the hands of the shareholder with effect from April 2016. The Final Dividend if declared will. Resignation of auditor under The Companies Act 2016.

Companies Act 2013. To issue a final dividend shareholders must grant their approval by passing an ordinary resolution at a general meeting or in writing. Final Dividend for the financial year ended 31 st March 2022.

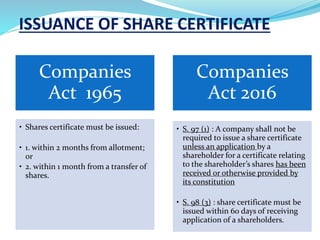

DIVIDEND- SECTION 235 Where in simple words dividend can be defined as the sum of money paid by a company to its shareholders out of the profits made by a company if so authorised by its articles in. 15-Nov-2016 by enforcement of Section. In the CA 2016 the dividend rule is found in s131.

2 Despite the Ministries Departments and Agencies Retention of Funds Act 2007 Act 735 the Public Financial Management Act 2016 Act 921 the Earmarked Funds Capping and Realignment Act 2017 Act 947 and any other relevant enactment the Office of the Registrar is authorised to retain all moneys realised in the performance of the. A lot has changed since decades-old IT Act. And 2 the dividend should not be paid if the payment will cause the.

Rule 1 to 10. Right to dividend rights shares and bonus shares to be held in abeyance pending registration of transfer of shares. The listed entity shall prepare and submit un-audited or audited quarterly and year to date standalone financial results on a quarterly basis in the format as specified by the Board within from the end of the quarter other than last quarter to the recognized stock.

Chapter VIII Declaration and Payment of Dividend Sections 123-127 Section 123. Chapter XIX Revival and Rehabilitation of Sick Companies Rules 2014. Declaration and Payment of Dividend Rules 2014.

Download complete list of Chapters and Topic wise all Sections of Companies Act 2013 as amended by the Companies Amendment Act 2020 in PDF format. Sections 253 to 269 has been omitted wef. SECTION 123 TO 127 OF COMPANIES ACT 2013 READ WITH THE COMPANIES DECLARATION AND PAYMENT OF DIVIDEND RULES 2014.

Rule 1 to 3. Where a declaration has been made and lodged in pursuance of section 257. Chandrasekaran at TCS AGM Our biz is only B2B we may get into B2C.

It has two principles ie 1 the dividend is to be paid out of the companys profits. Refer Chapter VIII of the Companies Act 2013 from Sections 123 to 127 and the Companies Declaration and Payment of Dividend Rules 2014 for provisions on Declaration and Payment of Dividend. The Board of Directors of the Company at the Meeting held on 18 th May 2022 recommended Final Dividend of Rs.

Templates of shareholders resolution for declaration of. 625 per Ordinary Share of Re. N Ganapathy Subramaniam of TCS.

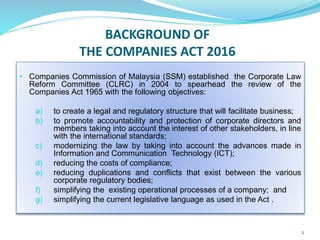

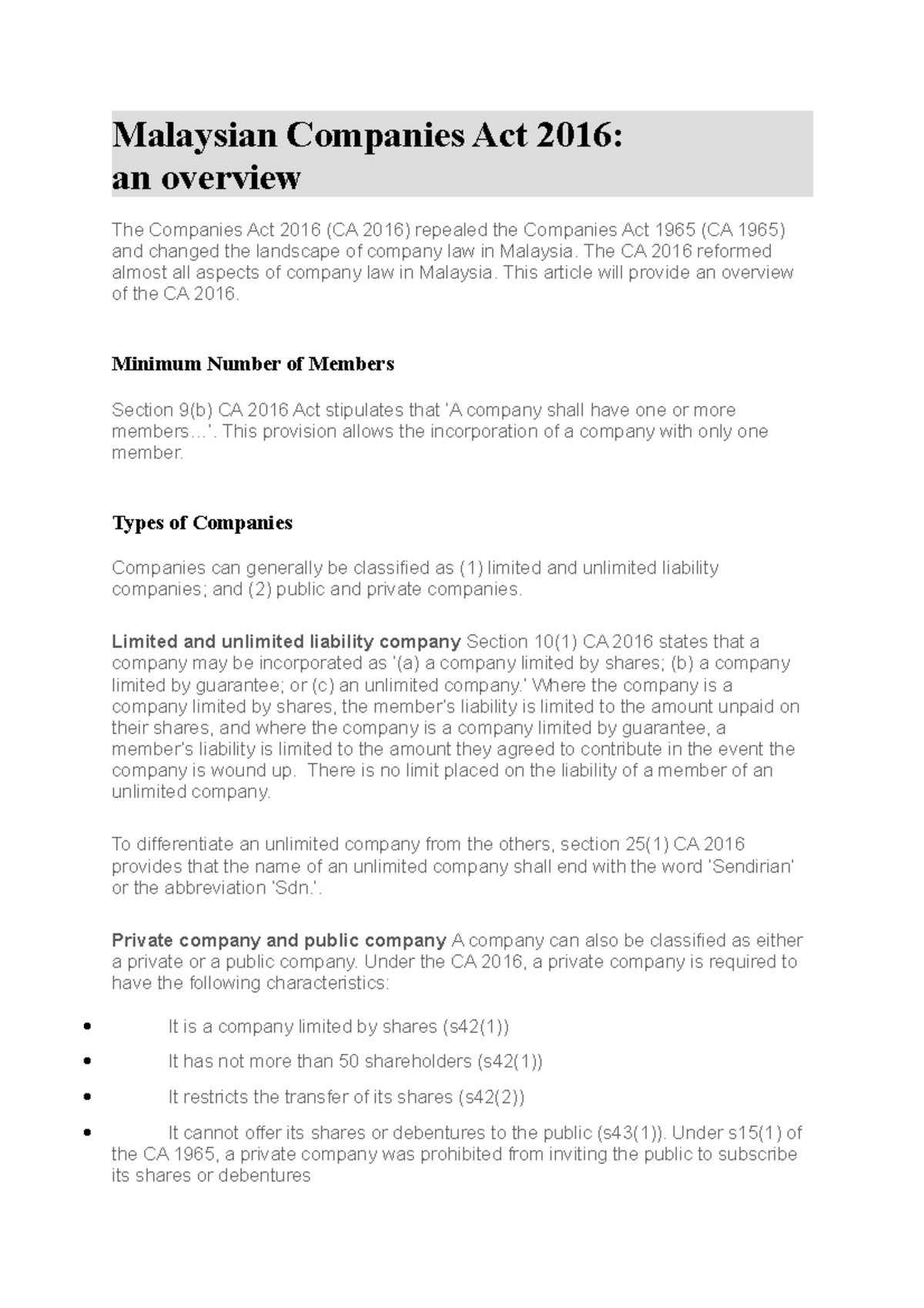

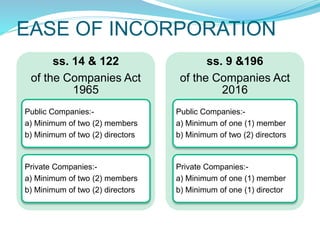

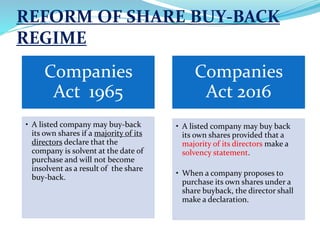

The Companies Act 2016 CA 2016 repealed the Companies Act 1965 CA 1965 and changed the landscape of company law in Malaysia. With notification of Section 248-252 by the MCA vide Notification No. The dividend received by the shareholders is then exempt in their hands.

Investor Education and Protection Fund. 1- each for the financial year ended 31 st March 2022 subject to declaration of the same by the Members at the 111 th AGM. There are two types of dividends interim and final.

Dividend-paying firms in India fell from 24 percent in 2001 to almost 19 percent in 2009 before rising to 19 percent in 2010. Continue reading LODR Regulation. Punishment for failure to distribute.

In the current years balance sheet 2016-17 how the accounting effect to be given to the final. Of Model Articles of Company Limited by shares as Contained in Table-F of Schedule-I of the 2013 Act. To vote on a resolution or to any right to participated beyond a specified amount in any distribution whether by way of dividend or on redemption in a winding up or otherwise.

Removal of Name of Companies from the Register of Companies Rules 2016.

Preference Shares Case Facts By Hhq Law Firm In Kl Malaysia

The Malaysian Companies Act 2016

_bill_2016_1510037412_19196-17.jpg)

Company Bill Powerpoint Slides

The Malaysian Companies Act 2016

Malaysian Companies Act 2016 The Ca 2016 Reformed Almost All Aspects Of Company Law In Malaysia Studocu

Constitution Of Company For Reference The Companies Act 2016 Public Studocu

Companies Commission Of Malaysia Faq Voting On Preference Shares And Single Member Public Company Meetings

The Malaysian Companies Act 2016

Capital Reduction Under Companies Act 2016 Client Alert March 2018 Capital Reduction Under Studocu

The Malaysian Companies Act 2016